The amount included in income is the inclusion amount (figured as described in the preceding discussions) multiplied by a fraction. The numerator of the fraction is the number of days in the lease term, and the denominator is 365 (or 366 for leap years). The business-use requirement generally does not apply to any listed property leased or held for leasing by anyone regularly engaged in the business of leasing listed property. Whether the use of listed property is for your employer's convenience must be determined from all the facts. The use is for your employer's convenience if it is for a substantial business reason of the employer. The use of listed property during your regular working hours to carry on your employer's business is generally for the employer's convenience.

Why Is Double Declining Depreciation an Accelerated Method?

The expected useful life is another area where a change would impact depreciation, the bottom line, and the balance sheet. Suppose that the company is using the straight-line schedule originally described. After three years, the company changes the expected useful life to a total of 15 years but keeps the salvage value the same. With a book value of $73,000 at this point (one does not go back and "correct" the depreciation applied so far when changing assumptions), there is $63,000 left to depreciate. This will be done over the next 12 years (15-year lifetime minus three years already). Both DDB and ordinary declining depreciation are accelerated methods.

How to calculate Depreciation

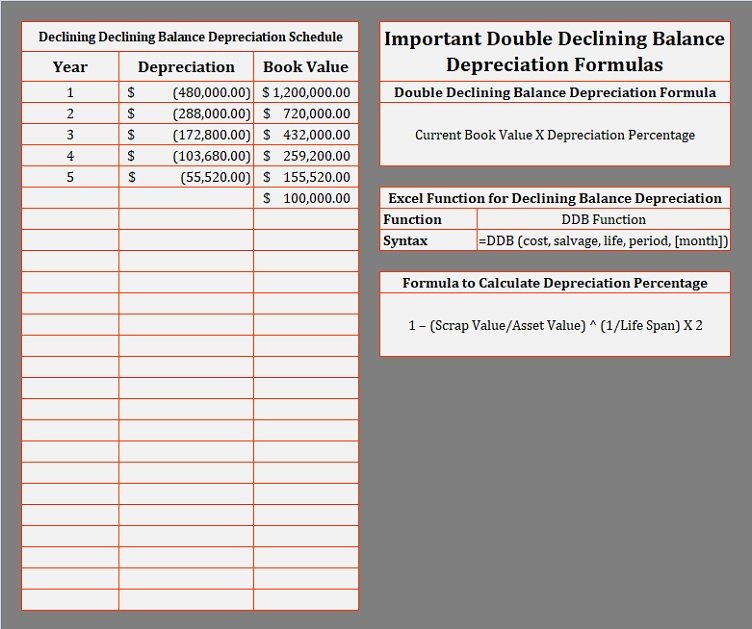

Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate. When the depreciation rate for the declining balance method is set as a multiple, doubling the straight-line rate, the declining balance method is effectively the double-declining balance method. Over the depreciation process, the double depreciation rate remains constant and is applied to the reducing book value each depreciation period. The book value, or depreciation base, of an asset, declines over time.

Double-Declining Balance (DDB) Depreciation Formula

In 2023, Beech Partnership placed in service section 179 property with a total cost of $2,940,000. The partnership must reduce its dollar limit by $50,000 ($2,940,000 − $2,890,000). Its maximum section 179 deduction is $1,110,000 ($1,160,000 − $50,000), and it elects to expense that amount. The partnership's taxable income from the active conduct of all its trades or businesses for the year was $1,110,000, so it can deduct the full $1,110,000.

However, in those cases where the asset has no residual value, this method will never depreciate the asset fully and is typically changed to the Straight Line Depreciation Method at some stage during the asset’s life. Thus, the Machinery will depreciate over the useful life of 10 years at the rate of depreciation (20% in this case). As we can observe, the DBM results in higher depreciation during the initial years of an asset's life and keeps reducing as the asset gets older. They determine the annual charge by multiplying a percentage rate by the book value of the asset (not the depreciable basis) at the beginning of the year. Under the declining balance method, depreciation is charged on the book value of the asset and the amount of depreciation decreases every year. Depreciation allows a company to deduct an asset's declining value, reducing the amount of income on which it must pay taxes.

What Are the Different Ways to Calculate Depreciation?

You did not claim a section 179 deduction and the property does not qualify for a special depreciation allowance. You used the mid-quarter convention because this was the only item of business property you placed in service in 2020 and it was placed in service during the last 3 months of your tax year. Your property is in the 5-year property class, so you used Table A-5 to figure your depreciation deduction. Your deductions for 2020, 2021, and 2022 were $500 (5% of $10,000), $3,800 (38% of $10,000), and $2,280 (22.80% of $10,000), respectively. To determine your depreciation deduction for 2023, first figure the deduction for the full year. April is in the second quarter of the year, so you multiply $1,368 by 37.5% (0.375) to get your depreciation deduction of $513 for 2023.

- However, the amount of detail necessary to establish a business purpose depends on the facts and circumstances of each case.

- In the last year of an asset’s useful life, we make the asset’s net book value equal to its salvage or residual value.

- You can file an amended return to correct the amount of depreciation claimed for any property in any of the following situations.

- Tara Corporation, with a short tax year beginning March 15 and ending December 31, placed in service on October 16 an item of 5-year property with a basis of $1,000.

Depreciation in the year of disposal if the asset is sold before its final year of useful life is therefore equal to Carrying Value × Depreciation% × Time Factor. No depreciation is charged business development business plan following the year in which the asset is sold. Therefore, it is more suited to depreciating assets with a higher degree of wear and tear, usage, or loss of value earlier in their lives.

You must generally file Form 3115, Application for Change in Accounting Method, to request a change in your method of accounting for depreciation. You can file an amended return to correct the amount of depreciation claimed for any property in any of the following situations. If you improve depreciable property, you must treat the improvement as separate depreciable property. Improvement means an addition to or partial replacement of property that is a betterment to the property, restores the property, or adapts it to a new or different use. If you do not claim depreciation you are entitled to deduct, you must still reduce the basis of the property by the full amount of depreciation allowable.

Payments of U.S. tax must be remitted to the IRS in U.S. dollars. Go to IRS.gov/Payments for information on how to make a payment using any of the following options. The IRS is committed to serving taxpayers with limited-English-proficiency (LEP) by offering OPI services. The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), most IRS offices, and every VITA/TCE tax return site. If you have questions about a tax issue; need help preparing your tax return; or want to download free publications, forms, or instructions, go to IRS.gov to find resources that can help you right away. If the element is the business purpose of an expenditure, its supporting evidence can be circumstantial evidence.

Generally, if the property is listed in Table B-1, you use the recovery period shown in that table. However, if the property is specifically listed in Table B-2 under the type of activity in which it is used, you use the recovery period listed under the activity in that table. Use the tables in the order shown below to determine the recovery period of your depreciable property. If you file Form 2106, and you are not required to file Form 4562, report information about listed property on that form and not on Form 4562. You can use the following worksheet to figure your depreciation deduction using the percentage tables. You must determine the gain, loss, or other deduction due to an abusive transaction by taking into account the property's adjusted basis.

Figure your depreciation deduction for the year you place the property in service by multiplying the depreciation for a full year by the percentage listed below for the quarter you place the property in service. If this convention applies, you deduct a half-year of depreciation for the first year and the last year that you depreciate the property. You deduct a full year of depreciation for any other year during the recovery period. On July 2, 2021, you purchased and placed in service residential rental property. You used Table A-6 to figure your MACRS depreciation for this property.